A LIBERDADE É UM IMPERATIVO

DA NATUREZA E A NATUREZA NÃO

NEGOCIA OS SEUS DIREITOS.

QUEM SOMOS

Fundado em 2010 com o objetivo de tornar-se referência na Advocacia Mineira, Bez & Machado é um escritório de advogados que trabalha com a agilidade que o cliente precisa para atender a estes tempos de informação rápida, com objetivo de proporcionar decisões acertadas e consistentes no plano jurídico.

Contamos com uma sólida e experiente equipe integrada por profissionais de mérito reconhecido, e com um ambiente muito bem localizado, otimizado e funcional, oferecendo um espaço aconchegante aos Clientes nos escritórios de Belo Horizonte, Juiz de Fora e Ubá.

ATUAÇÃO

DIREITO BANCÁRIO

Atuamos em consultorias em contratos bancários, câmbio, capital estrangeiro e legislação do Banco Central do Brasil, bem como defendemos os clientes em processos administrativos e judiciais.

DIREITO CONTRATUAL

A redação adequada de um contrato evita mal-entendidos e favorece o seu integral cumprimento pelas partes contratantes. Possuímos uma equipe dedicada que analisa e redige contratos a serem firmados por nossos clientes, proporcionando negociações seguras e saudáveis, alinhados com as mais recentes inovações legislativas, doutrinárias e jurisprudenciais.

DIREITO DIGITAL E COMPLIANCE

A aplicação da tecnologia e o avanço do uso da Internet nas relações pessoais e empresariais geram complexas questões jurídicas até então inexistentes. Nossa equipe conta com advogados especialistas que entendem de tecnologia e que possuem profundo conhecimento jurídico da área, combinação esta imprescindível para a prestação de serviços de excelência e adequadas às necessidades de nossos clientes dentro do universo digital.

A implementação de um programa de compliance parte do conhecimento profundo da empresa e dos riscos a que se expõe, de forma a criar mecanismos de prevenção ou mitigação de seus impactos. Um programa de compliance deve ter como objetivo proteger a imagem da empresa, inibir a ocorrência de fraudes internas ou externas, e afastar a empresa do risco de sofrer penalizações por entes reguladores, judiciais e demais autoridades públicas. Nossa equipe conta com profissionais especializados em tecnologia de ponta para realizar a implementação do Programa de Compliance nas empresas de todos segmentos.

DIREITO EMPRESARIAL

Prestamos assessoria a clientes, nacionais e estrangeiros, na gestão, organização e planejamento dos mais variados assuntos comerciais e societários no contexto jurídico. Realizamos todas as due diligences para a sua empresa.

DIREITO TRABALHISTA

Acompanhamos e representamos os nossos Clientes em todos os assuntos e operações relevantes em matéria trabalhista, quer na vertente de preventivo, quer no acompanhamento de processos de natureza consensual e contencioso judicial, junto dos tribunais do Trabalho e dos Tribunais Superiores.

DIREITO TRIBUTÁRIO

A análise adequada das obrigações tributárias, seja em operações específicas ou em atividades rotineiras, é essencial para o planejamento pessoal e empresarial, pois permite a otimização de resultados e reduz os impactos fiscais envolvidos. Nossa equipe assessora os clientes nas questões tributárias que envolvem suas operações e atua, nas esferas administrativa e judicial, para defendê-los contra autuações fiscais e recuperar/compensar créditos tributários.

EQUIPE

Ronaldo Machado Nascimento Sócio Fundador do Escritório Bez & Machado Advocacia

Advogado, Bacharel em Administração de Empresas, Pós Graduado em Direito Tributário, Direito Contratual e Direito Digital e Compliance. Atua especialmente nas áreas de consultivo/contencioso Tributário, Empresarial e assessoria na implementação da Lei Geral de Proteção de Dados Pessoais e Compliance.

Rafael Steckert Bez Sócio Fundador do Escritório Bez & Machado Advocacia

Advogado, Bacharel em Administração de Empresas, Pós Graduando em Direito do Trabalho e Processo do Trabalho e Direito Digital, possui expertise com atendimento às causas empresariais e pessoais.

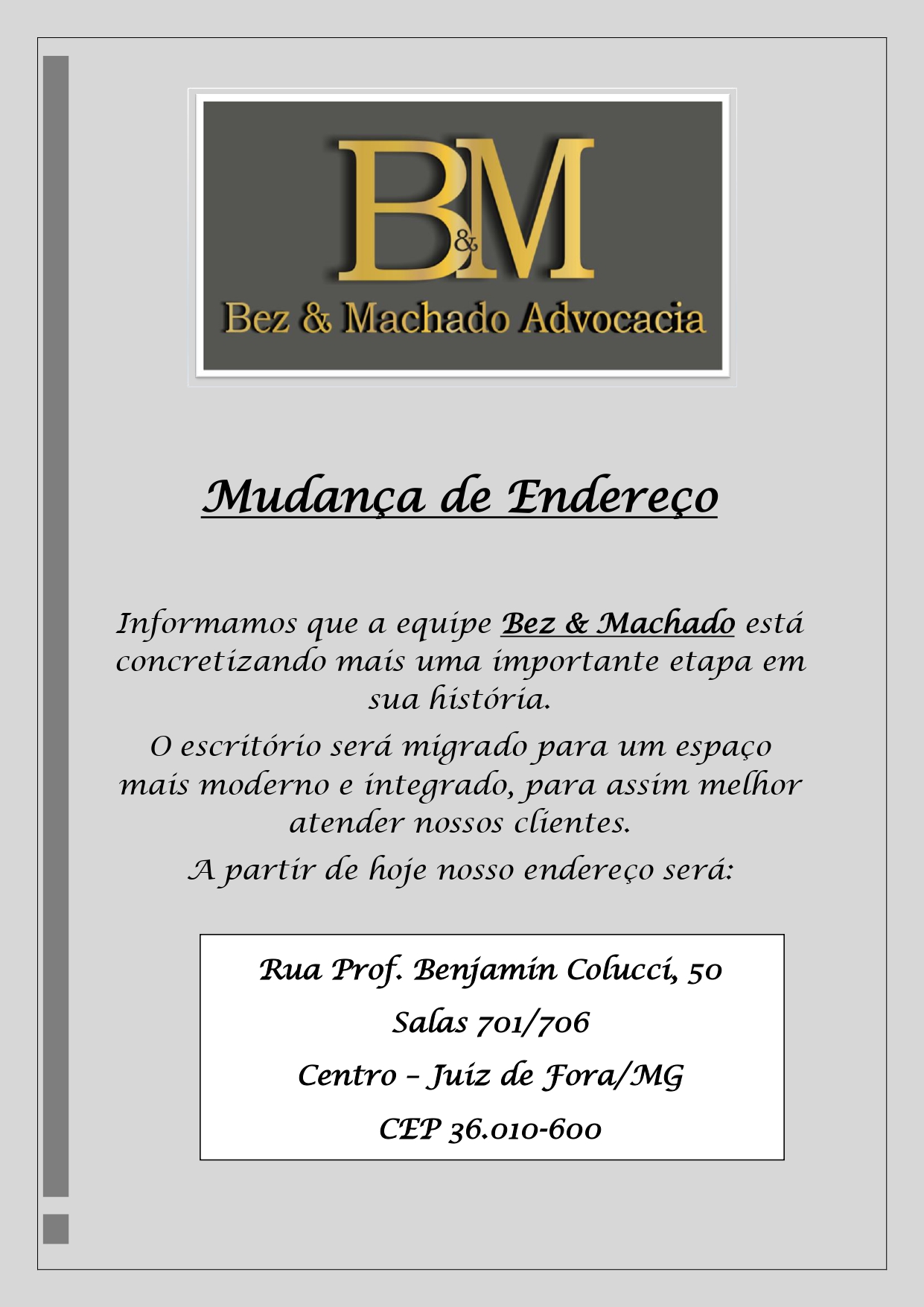

CONTATO

Insira aqui o conteúdo.